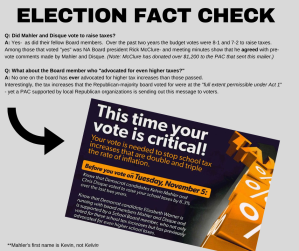

Save NA Schools fact-checked a recent flyer mailed to North Allegheny residents by a local political action committee.

The findings are below.

——

Q: Did Mahler and Disque vote to raise taxes?

A: Yes- as did their fellow Board members. Over the past two years the budget votes were 8-1 and 7-2 to raise taxes.

Among those that voted “yes” was NA Board president Rick McClure- and meeting minutes show that he agreed with pre-vote comments made by Mahler and Disque. (Note: McClure has donated over $1,200 to the PAC that sent this mailer.)

Q: What about the Board member who “advocated for even higher taxes?”

A: No one on the board has ever advocated for higher tax increases than those passed.

Interestingly, the tax increases that the Republican-majority board voted for were at the “full extent permissible under Act 1” – yet a PAC supported by local Republican organizations is sending out this message to voters.

Q: Did Mahler and Disque “refuse to consider an alternative and lower tax possibility?”

A: The “alternative” was only offered minutes before the vote, rather than at any time during the six month budgeting process. The change would have further depleted the district’s fund balance, likely lowering NA’s bond rating and costing taxpayers more in the long run. It’s important to understand that seven of nine Board members voted for the higher rate, not just Mahler and Disque.

Q: Tell me again about the Board member who “advocated for even higher taxes?”

A: Again, no one on the board has ever advocated for higher tax increases than those passed. In fact, any school board wishing to increase taxes higher than the Act 1 index and exceptions would need to seek voter approval through a formal referendum process. The last time a referendum was suggested was 2012– before Mahler and Disque were elected to the NA School Board.

Q: Were school taxes raised by two to three times the rate of inflation? What is the alternative?

A: No- last year the tax increase was 3.7%; inflation was 2.44%. A home valued at $238,500 saw a yearly increase of $163. Without this modest millage rate increase in 2019-2020, the Board would have needed to raid the fund balance or make dramatic cuts to programming. To equal the $4M raised through the millage rate adjustment, a Board Member calculated there would have to be cuts made to music, class sizes, technology, and school safety.